Money Saving Tips

The best ways to save for a house deposit.

Tom Pressman

21-03-2025

How to save for a house deposit.

Create a budget.

Working around a monthly budget is an important way to manage your spending. Begin by tracking your monthly expenses to gain an insight into exactly how much you can realistically set aside for your housing deposit. Identify areas where you can cut back and establish an achievable monthly budget.

Maintaining discipline and consistency is crucial for success. While it may require adjustments and sacrifices, the satisfaction of seeing your savings grow steadily will be worth the effort when you finally own your home.

Automate your savings.

A sensible way to set money aside is by setting up automatic transfers from your bank account to your savings account. This way, you’re guaranteed to save and won’t be as tempted to spend because the money isn’t just sitting in your account! Just think of this as a regular bill payment that is taken from your account every time you’re paid.

.webp)

Cut down on spending.

Okay, listen up. When we say ‘cut down,’ we don’t mean eliminate entirely. We all have hobbies, interests and social occasions to attend that all require money, and these are extremely important to maintain and enjoy! So, what we mean is to just be savvy about how you tackle these things financially.

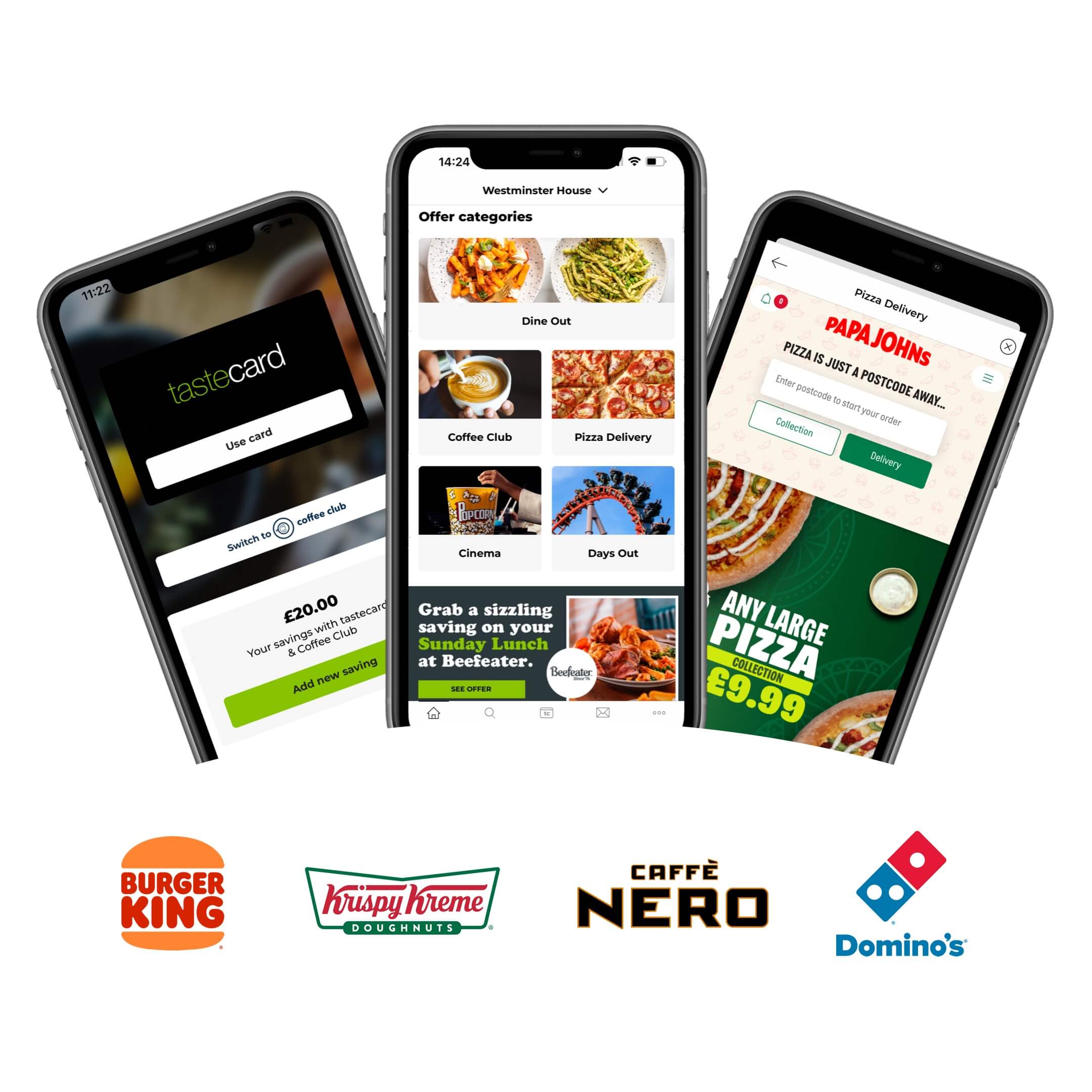

Let’s say you’re a foodie, a film fanatic, a coffee lover or are constantly looking for ways to keep the kids entertained during the half term; tastecard is a fantastic way to enjoy all of these for less! With restaurant deals, discount days out, coffee deals, and discount cinema tickets, tastecard helps cut the cost of a whole variety of activities.

After all, saving for a house takes time, so it wouldn’t be sustainable to cut out all of these things entirely! Look for alternative, more affordable options or find ways to minimise expenses in these areas. Every pound saved can make a significant difference in building your house deposit over time.

Evaluate your housing needs.

Evaluate your housing needs and explore downsizing to a smaller home or apartment. Moving to a property with fewer bedrooms or less square footage typically comes with a lower price tag. Additionally, seek out neighbourhoods or areas that offer more affordable housing without compromising convenience or safety.

.webp)

Consider government assistance programs.

Our final tip for how to save for a house deposit is to research government schemes that can assist first-time homebuyers. In the UK, there are initiatives like deposit assistance for first-time buyers that are designed to help individuals save for their first home.

Images sourced from Adobe Stock.

Join tastecard today.

If there’s one thing definitely worth investing in, it’s tastecard! tastecard is all about supporting you in saving money whilst helping you get out and make memories with your loved ones. The road to buying a home is a long one, but make it fun along the way! Download the tastecard app today, and trust us to help you out with your savings.